In November 2022, eTides, the previous platform used to file PA Sales Tax was retired and all users are required to create a MyPath Login to file and pay their sales tax from November 2022 on.

Let’s get you signed up so you can file your sales tax and manage any other PA accounts for the business.

- Head to: https://www.mypath.pa.gov/_/

- Under New to myPath? Click Sign Up

- The next screen will review the types of taxes that will be available on MyPath, click Next

- Check that you agree, click Next

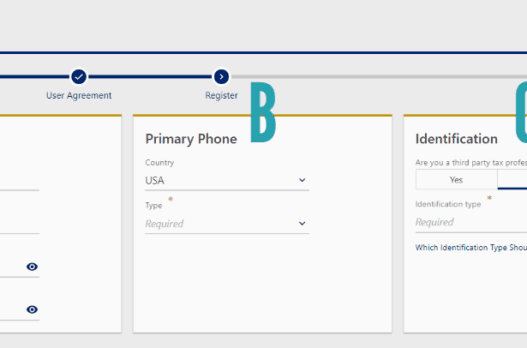

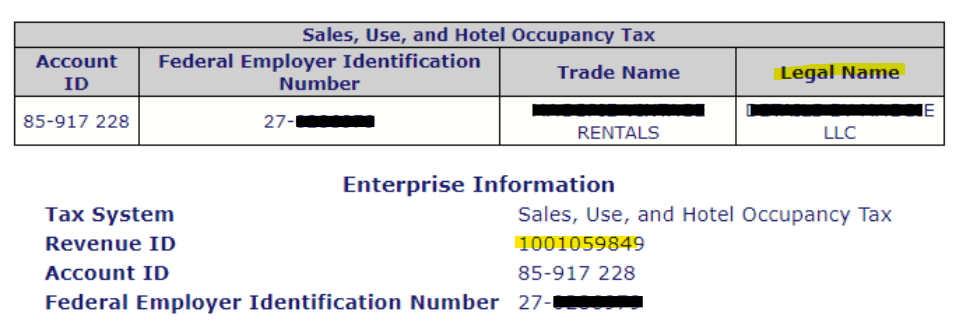

Let’s break this Logon Registration screen down into three columns.

In Column A you need to input:

- A unique email address that is not associated with any other myPATH profile

- A unique username must be a minimum of 5 characters (no special characters)

- Passwords must be a minimum of 8 characters and must contain at least one of the following: uppercase and lowercase letters, numbers, and special characters.

In Column B, you must choose the Type of Phone Number you want to use, Business, Cell, or Home.

In Column C, you must verify the account that you want to bring over.

- Choose NO to the third-party tax professional question

- You can choose either the EIN, the employer identification number, or the Revenue ID, I suggest that you use the Revenue ID.

To find out what your Revenue ID number is:

- Head back to eTides, the old platform that you used to use. https://www.etides.state.pa.us/

- Log On to your account

- Choose Enterprise Maintenance

- Select Sales, Use, and Hotel Occupancy Tax from the drop down menu

- Click Next

- Choose your business

- Click Select

- Choose View Enterprise Information

- Click Next

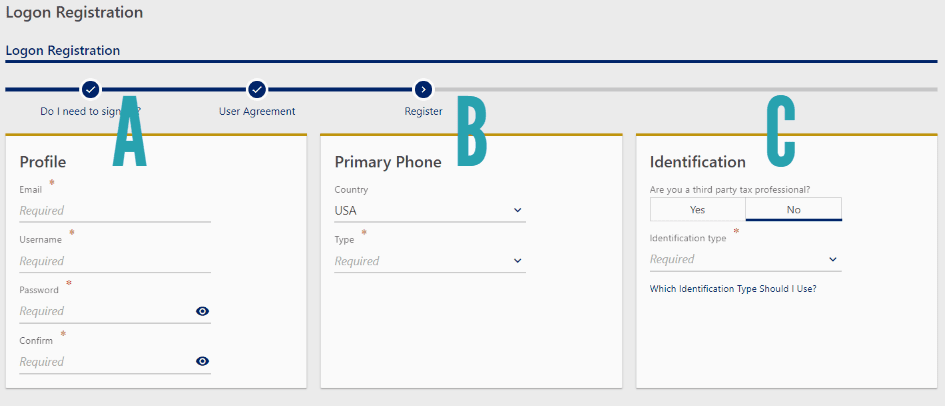

This screen shows you your Revenue ID and your Legal Name that is on file with PA, which you will also need to confirm.

- Head back to your MyPath registration and input the Revenue ID number and the Legal Name of your business.

- Click Next

- If PA finds a match for your business, you will get taken to a screen to verify details about your account.

- Choose Sales and Use Tax from the long list of items

- Choose Payment Amount as the option for what you want to verify

Then head back to your eTides account

- Click on Filing History

- Select Sales, Use, and Hotel Occupancy Tax from the drop-down menu

- Click Next

- Choose your business

- Click Select

- You’ll see your total tax payments listed there

- Don’t choose the most recent one, but choose one of the last five payments. I’d suggest using one that is a month or two back.

- Write the amount down, even the cents.

Head back to MyPath

- Enter that exact amount into the system for verification.

- You can choose to opt-in for electronic mail delivery or not.

- Choose Submit to see if you got a match.

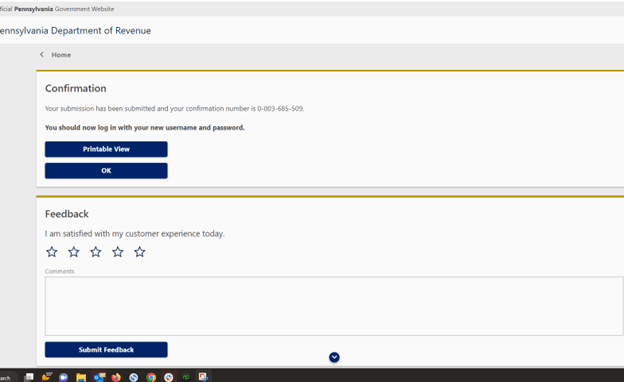

If you did everything right, you should get a confirmation that looks like this:

- Click OK to get taken back to the main screen.

- Enter your username and password to log into your account for the first time.

- The first step is to set up 2 Factor Authentication. You can enter your email, a phone number or the authenticator app.

- The phone number does NOT have to be the same one that you input when initially signing up.

- Then you have to set up a secret question.

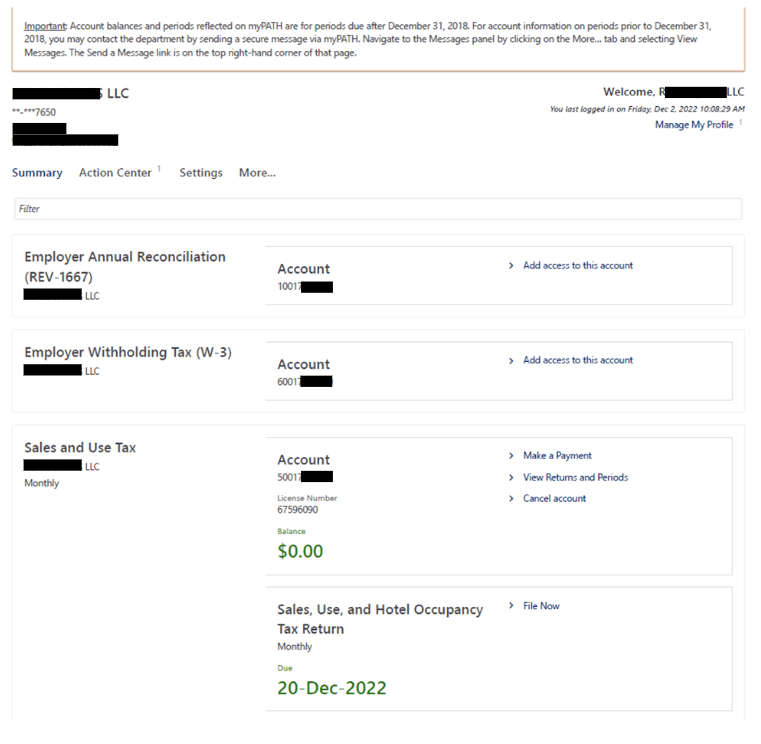

Once you’re in, it should look like this:

Now you have access to all of your sales and use tax accounts to file returns. And if you have employer withholding accounts because you pay payroll, you’ll see those listed too!