So you’re thinking about going S Corp or making an S Corporation election or electing to have your entity taxed as an S Corporation. Let’s talk about what that even means, the pros, the cons, and other information you should consider before making this jump.

Under the right circumstances, electing S Corp can save you thousands of dollars every year in taxes. But depending on your tax situation, how high or low your income is, your home state, and many more variables, electing to have your entity taxed as an S Corp won’t save you any money at all. Going S Corp is a varsity business move; it’s not for everyone; sometimes, it just doesn’t make sense, and that’s okay. But that’s why we’re going to talk about pros and cons and what it means for you as a business owner, so that you can make the decision for yourself.

An S Corp is not a standalone entity; there is no such thing. You first have to set up an entity at the state level and then elect to have that entity taxed as an S Corporation, so let’s talk about your entity first.

Entity structure

Your entity is established at the state level. Your entity can be established as a limited liability company or a corporation.

If that’s all you do, you report your business income and expenses on Schedule C if you’re a single-member LLC, a Form 1065 partnership tax return if you’re a multi-member LLC, and a Form 1120 if you’re a corporation.

Those are the default tax forms for those entity types, but the IRS also allows you to make an election to be taxed as an S-Corporation. Depending on your tax situation, your expected earnings over the life of the business, and your state of operations, electing S-Corp status can save you thousands of dollars in taxes and tens of thousands over the life of the business. But it’s not for all businesses.

An S-Corporation is like a marriage. Easy to get into, hard to get out of. If you decide you’re not interested in the business, the S-Corporation needs to be terminated, the business needs to reclassify itself as an LLC, a final tax return must be filed, and payroll accounts need to be closed. And, you have to wait five years before electing S-Corp status again.

It is a lot, so this is not a decision to be taken lightly because the administrative work can take hours and hours of your time every year over the life of the entity.

If you’re already an LLC or a C-Corporation, you’ve already completed step 1 and may move on to step 2.

If you’re just a sole proprietor, you’ll first need to set up one of these entities and then immediately elect to be taxed as an S-Corp with the IRS and state, if you’re required to file a separate election.

Don’t get cute by trying to organize an entity in a state without state income taxes. You pay taxes based on where you’re operating and generating income, not where you registered your business. The additional state involved usually just means more returns and higher tax prep fees.

Benefits of an S-Corporation election

There are definite advantages to having an S-Corporation, so let’s highlight those.

All taxable income from the S-Corporation passes through to the owner’s individual income tax return, so federally, there is nothing due when filing the S-Corporate return. Instead, a K-1 is produced within that S-Corp tax return that shows your share of income earned from the business, based on your ownership percentage. You’ll input that K-1 into your personal tax return to pay taxes on the income.

But that income that passes through no longer is subject to social security and Medicare taxes, also known as self-employment taxes. So this is the reason that S-Corps can be beneficial to certain businesses.

The avoidance of self-employment taxes does come with a catch because you are required to pay yourself a payroll as you are now an employee of your business. You can pay yourself every other week, once per month, or once per year; the IRS doesn’t care, as long as you take payroll because that payroll is subject to SS and Medicare taxes.

But the requirement to take payroll also forces the owner to pay federal income taxes with each check before the direct deposit ever hits your bank account. So if you plan properly, that means reducing or eliminating quarterly estimates altogether because you’re able to pay in towards your federal ordinary income taxes during the year.

Remember, the S-Corp allows you to avoid self-employment taxes, but not ordinary income taxes. Your S-Corp income is still taxed as ordinary income for federal income tax purposes.

Downsides of being an S-Corporation

All that glitters can’t be gold. Unfortunately, the ability to avoid self-employment taxes on the pass-through income comes with a few catches.

S-Corps can only have 100 shareholders. For most small businesses, that’s just fine. But if you plan to offer shares of stock to more than 100 shareholders, an S-Corporation is not the right choice for you.

Reasonable compensation. The biggest trick with your S-Corporation is to pay yourself enough in salary through your W-2 wages to not pique the interest of the IRS, but not pay yourself too much in wages, because that’s where we see the actual S-Corp savings erode away. It’s a very fine line to walk, and one that the IRS doesn’t provide a lot of guidance on because what reasonable compensation is for a Florist in Idaho or on Nantucket will be very different answers. So the business owner and their decision-making team is responsible for coming up with a reasonable salary every year for any Officers involved in the day-to-day.

Business payroll tax expenses. When you pay yourself a reasonable compensation, half of the social security and medicare taxes are paid by you, the employee and half of the SS and medicare taxes are paid by your employer, oh wait, that’s still you. So the business has to cover the employer side of payroll expenses, we usually estimate about 9-10% of your wages. The good news is that that’s a business expense to reduce your taxable income, but it’s still more money out of your business bank account.

The entity will face more IRS scrutiny. Since there are more business requirements as an S-Corp, annual shareholder meetings, the reasonable compensation we just talked about, you’re opening yourself up to more scrutiny as a small business by electing S-status.

There is more administrative work. Sorry! An S-Corp just brings with it more paperwork, tax registrations for payroll, phone calls with your payroll rep when they get things wrong, and likely IRS notices because they forgot they approved your S-Corp and were looking for your 1120 C-Corp tax return. We’ve been working with hundreds of clients who are S-Corps. Trust me, they ALL take more admin time than an LLC.

Social security basis. You’ll be avoiding social security taxes by design. This means that the only basis you’ll have in social security earnings come retirement time will be from the W-2 salary that you pay yourself, so your social security earnings over your lifetime will be LOWER than if you stayed a single-member LLC and paid self-employment tax on all of those earnings.

On-going expenses for payroll processing and tax filing. If you take a year off and have no income in the business, as an S-Corporation, you’ll still have to file payroll taxes monthly, quarterly, and annually and you’ll still have to have a tax return prepared.

Time is running out. You only have a certain period of time during the year to elect S-Corp status, and then you have to wait until next year. You have 75 days from the beginning of the tax year to elect S-Corp status. Otherwise, you have to wait until the next year if you’re past March 15. The only way around that is to set up a new entity; then the 75 days starts when that entity was created.

You shouldn’t be an S-Corp if….

- your business is a hobby

- your business is just holding or renting real estate – that income isn’t subject to self-employment taxes anyway, so no need for the S election to help you with that

- you’re not sure you’ll be in business in 5 years

- you’re not sure you’ll be interested in the business for the foreseeable future

- your business income is projected to be over $300k per year

- you have W2 income close to the social security limit

Examples

Words only go so far, I get that, so let’s talk about some examples. Here are three different scenarios.

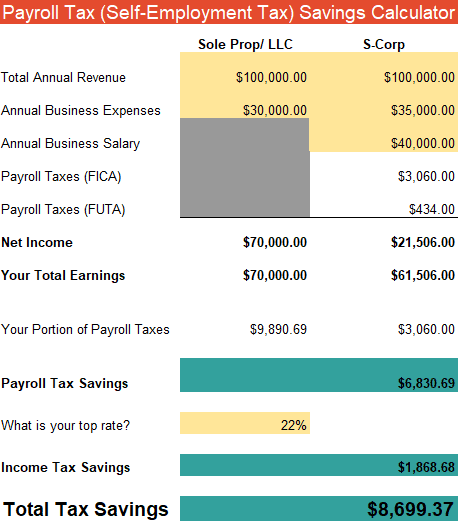

The first shows a business that nets about $70,000 after paying all expenses. If they file as a sole proprietor or single-member LLC, they’ll put that $70,000 on their Schedule C within their individual income tax return and pay both self-employment taxes and income taxes on those earnings.

If they were to elect S-Corporation status for their business, their expenses would increase by about $5,000 for tax preparation of the S-Corporation’s return, as well as payroll costs and other miscellaneous expenses related to staying in compliance as an S-Corp. But they’d put themselves on salary for $40,000. So they’d earn $40,000 as an employee of the business, and after the additional operating expenses and payroll expenses related to that $40,000 of payroll, they’ll earn $21,506 as the owner of the company. And remember, the savings is in the remaining S-Corp profits, in this case, $21,506 because S-Corp income is not subject to Self-Employment Tax. That’s a combined $61,506, compared to $70,000 as a Schedule C. But remember, the payroll taxes related to your wages were paid through the business so they’re a business expense, as opposed to self-employment taxes paid on Schedule C income, which is NOT an expense for the business.

If we assume the taxpayer is paying tax on income in the 22% tax bracket (that’s their top bracket), that taxpayer can assume tax savings of about $8,700. So after factoring in the additional $5,000 of costs that we planned for, that’s tax savings of about $3,700.

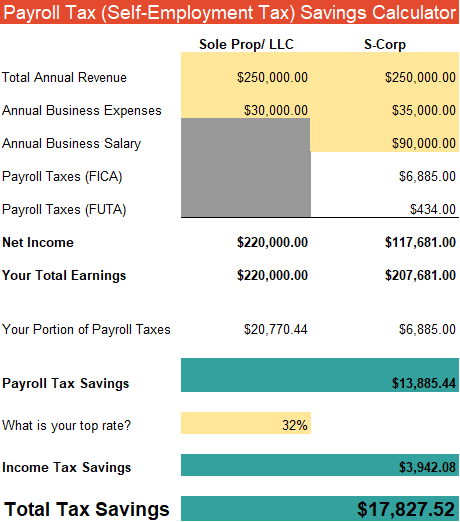

The other example is someone who is able to net $220,000 from their Schedule C. If we elect S-Corp status, and pay them $90,000 as an employee, then their total earnings are $207,681. If 32% is the top tax bracket, we’re looking at tax savings of $17,800 before factoring in the extra $5,000 of expenses and $12,800 after.

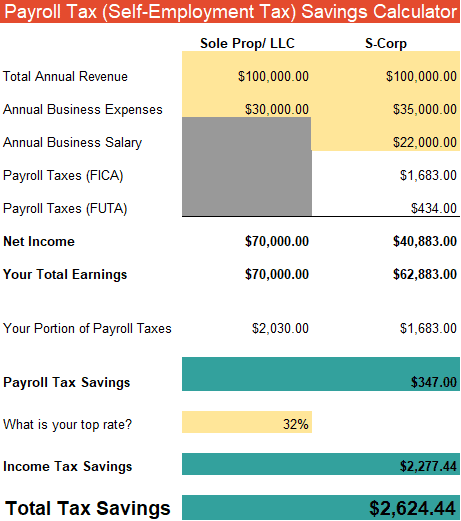

The last example is someone who has a W2 job with a business that they don’t own that pays them $125,000. Because they pay into social security and medicare through their W2 job, there is not as much advantage to electing S-Corp status because any Schedule C income they have, wouldn’t be subject to Social Security taxes over the limit for that year, $147,000 for 2022. So as your earnings from sources that pay into Social Security taxes increase, the S-Corp benefit becomes less attractive. In this case, it cost the taxpayer money because they had to put out $5,000 of additional expenses, and only saved about $2,800.

Now you can see why tax planning and strategy are so important and how one election can save you thousands of dollars. But remember, it’s all based on how well the business is doing, what other factors play into your tax situation, and how you structure your business. It’s something that you have to keep on top of and will need adjusting every year.