The City of Philadelphia has a new website! If you operate your business in Philadelphia and file BIR, NPT, or Wage tax returns, it would behoove you as a business owner to get set up on the new platform NOW, rather than when you need it down the road as penalties and interest accrue on your account.

The progress to login can take a few weeks because the initial login must be confirmed by a Letter ID that you’ll receive by horse and buggy the USPS. That’s the main reason why it’s important to start the process now rather than later.

If you file a BIR, NPT, or Wage tax return, if there are any future issues, you need to use the new Phila.gov website to receive notices, respond to issues, and stay compliant with Philly. You can even file and pay your taxes directly through the website, but you don’t need to worry about that feature if you have us filing your taxes for you.

Verify Your Address

Before we can get access, we need you to ensure that the address the City has on file for you is your current address. Because once you log in to the new website for the first time, before you can do anything within your account, the City is going to mail you a letter, at the address they have on file, to verify your login attempt. Unless you’ve recently received mail from the City and you know your address on file is accurate, give them a call at (215) 686-6600. Call before noon or after 3 pm, and there is a chance you won’t be on hold for long, but sometimes you can expect to sit on hold for an hour before someone answers.

When they answer, give them your business information, name, EIN or SS#, and current Philly account number, all of which can be found on your filed tax returns. Make sure you give them your current address or verify that’s what they have on file, and that’s it.

Time to Get Logged In

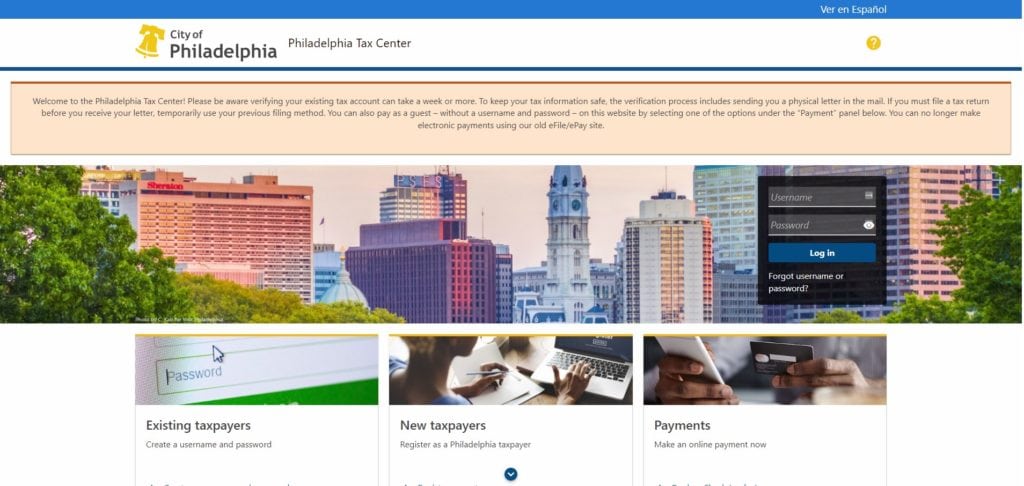

- Head to the website tax-services.phila.gov.

- Under the “Existing taxpayers” panel on the left side of the Philadelphia Tax Center’s homepage, select “Create a username and password.” The site prompts you to:

- Provide your Social Security number (SSN) or Federal Employer Identification Number (FEIN). The SSN or FEIN you provide must match the information we have on record.

- Provide some contact information.

- Then you get to actually create a username and password (save these, you will need them in the next step).

- Go back to the tax-services.phila.gov website

- Enter in your username and password, click LOGIN

- Follow the steps to set up 2-factor authentication

- Then follow the steps to request an access letter.

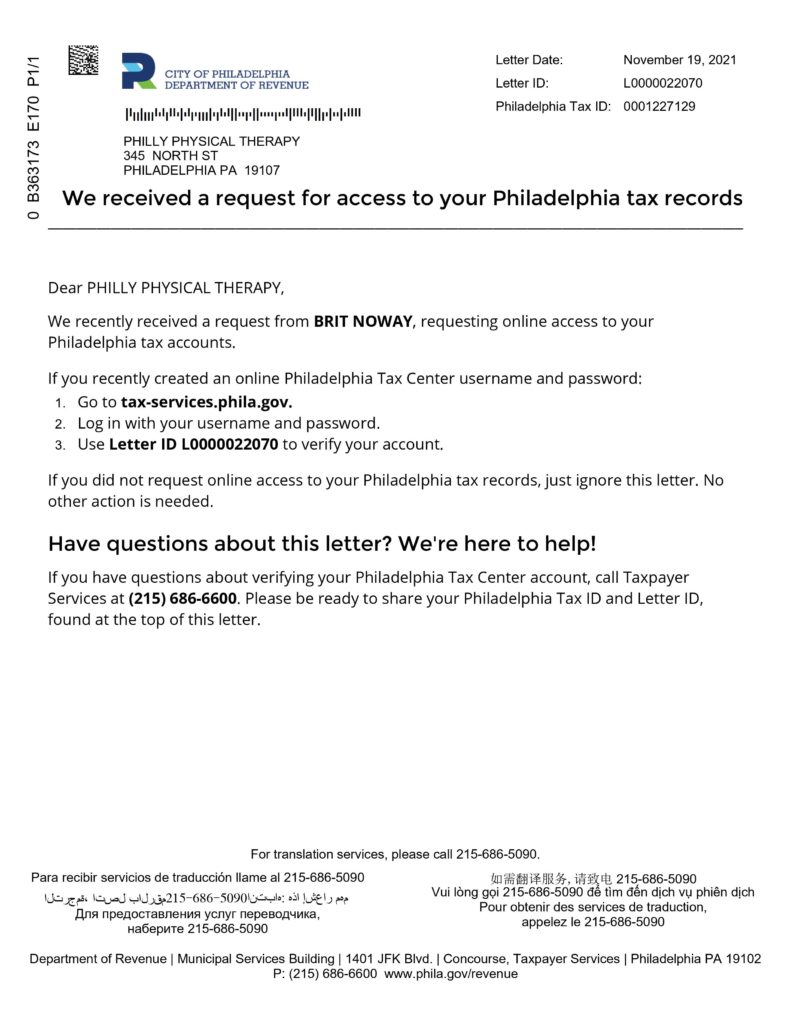

This letter will be sent to the address they have on file. You NEED the unique Letter ID on this letter to be able to access your account and to be able to give us your login so that we can access it for you.

It will take 5-10 business days to get to the address they have on file. The letter will look, like this.

When You Receive the Letter

Once you have the letter ID, log back into your account, input the ID, and boom! You’re in.

Keep this username and password near and dear to your heart and at the top of your password manager. If you get a notice or letter or any communication from the City and we need to respond, it will have to be through this website. So we’d rather have you set it up now, rather than when interest and penalties could be accumulating.

If you have any questions, to confirm your account number, business name, EIN, or anything – let us know.

Video Describing the Process