This is a common question we get asked when talking to prospective clients. Whether you’re a sole proprietorship, LLC, or S-Corp – it doesn’t matter which entity setup you are – taxes and financials are complicated and constantly changing. If you’re asking that question, the answer is probably yes. But we might be a little biased.

So instead of answering that for you directly, we’re going to talk about the differences between what a bookkeeper does and what an accountant/tax preparer/CPA does for a small business. We’re going to discuss situations we see often with prospective clients, and success stories and benefits of having an accountant on your team. And then you can decide if you need a CPA for your small business.

What is a bookkeeper?

A bookkeeper is a person (or team) who is in your books daily, weekly or monthly, depending on the needs of your business. They ensure that your transactions are recorded properly and accurately.

If you’re just starting out and you want to do the books yourself, you absolutely can, but eventually, your time will be better spent elsewhere. Whether that’s time off or generating sales, sometimes it’s nice to have an expert with experience overlooking your financial situation.

Some examples of tasks that a bookkeeper can take off of your plate include:

- Managing all bank, credit card and loan accounts via QuickBooks or other accounting software

- Ensuring data entries reflect real-time business operations

- Keeping the business aligned with all local, state, and federal laws

- Preparing all tax information (making it seamless for an accountant)

- Overseeing business-related software, apps, etc. related to bank feeds

- Handling accounts payable

- Preparing invoices

- Producing inventory reports

- Analyzing revenues/expenses

There are some extremely tedious but necessary tasks that need to be done as a business owner. And many of them can be handled by someone who has experience with such tasks like invoicing, payments, sales tax filings and reconciliations.

Most important, though, is having accurate books and records. This is really important for tax return preparation, budgeting, data analysis, growth, and cash flow.

If you do it right, the bookkeeper that you hire should save you more money than they cost.

What is an accountant?

While the bookkeeper is dealing with the nitty-gritty and the day-to-day transactions, the role of your accountant is much more high level.

The accountant that you have on your team is an essential role in the overall growth and direction of your business. In addition to assisting in improving the bookkeeper’s processes and procedures, and verifying that the financials produced by your bookkeeper are accurate, the accountant will help interpret the financials and help you discuss strategy based on trends and the expected future income.

The accountant should also meet with you throughout the year to discuss tax planning and strategy. There are definite advantages to knowing what your tax bill will be in July of the current year, instead of April of the following year, where you have no option but to pay what is owed. There are tax planning strategies to employ, concepts to explore, and programs to take advantage of with enough time left in a tax year. But most importantly, the additional time allows you to plan for that tax bill and either stash money during the year, or pay some tax estimates in to lessen the burden come tax time.

As long as your accountant files your individual and corporate taxes, if needed, and provides both consulting/tax planning services, the bookkeeper and accountant should be more than enough of a financial team for most businesses at the start.

Situations We See Often with Prospective Clients

Usually, our prospect calls for our small business clients fit into one of two profiles of business owners.

Newbie

They’re just starting out in business. They just realized that their passion or hobby is something that people will pay money for. They don’t know if they’re actually “in business” because their business activity is fairly minimal at the get-go. And they’re not even sure that their level of activity even justifies the cost of an accountant.

Confident

They have been in business for 3-5 years and they’re confident in their knowledge of business finances and taxes and figure that they can get by filing their return on TurboTax. Which usually works for a while, maybe even for years. The problem arises when they get a notice for years of taxes owed that wasn’t even on their radar. These can be sales tax, payroll tax, local municipal tax, state tax. And once a few years goes by, not only might you have to make up for those amounts you would have owed, but you also have to change how you operate going forward. And this can be a challenge for entrepreneurs that have already set up processes and procedures in their business and now have to restructure or rethink how they do things.

Success Stories and Benefits of Having an Accountant on Your Team

We love when newbie business owners call us. It’s so much easier to start your business off on the right foot. From a tax perspective, understanding how your business is taxed (depending on the type of entity that you have), and from a financial reporting perspective, understanding how your financials should be setup, and most importantly, what they’re telling you. From a growth and direction perspective, setting goals for the future, and depending on the landscape of the current economic environment, how to best achieve those goals as the years go on, costs go up and there seem to be fewer hours in the day.

While newbie business owners can get by for a while, making enough money to live, what is often a shock is the amount of taxes owed on the income they generate. When a newbie comes on board with us early in their business life, they’re confident that they’re going to know what their tax burden is months ahead of when the tax return is due so they can either pay in some estimates to lessen the burden, or at least stash some money away so that they don’t spend their tax money. And they’re also going to know exactly what other taxes (payroll, sales, etc) their business is subject to so that they can operate without any concern of non-compliance.

It’s so much harder to unravel the issues that confident business owners can have. Those who made just a few critical mistakes along the way and are just now reaching out for help. There is nothing wrong with this mindset, but there are definite advantages to having an expert on your team early on that is knowledgeable about compliance requirements, especially in tax areas, because the penalties, interest, and most importantly, time to correct these errors can be costly.

It’s not too late to right wrongs and work towards operating your business worry-free. We’ve faced plenty of situations where taxes weren’t filed for years, and sales tax was never collected, or the business was operating in a municipality without proper licensing, or payroll taxes weren’t remitted on time, etc. And all of those instances have been solved without anyone getting in trouble, losing their house, or going to jail. Accountants, especially us, have seen just about everything, so don’t think you’re alone.

After going through the chaos of the pandemic with a few hundred business owners, we also were reminded of how important it is for business owners to have access to accurate and complete financials when applying for loans and grants. Not only was it important to prove eligibility for certain programs and to determine the amounts they would qualify for, it was also important for business owners to really study their overhead costs, the costs that they have regardless of whether they make a sale or not, and figure out which expenses they could cut and do without, or defer and pay when the business could afford it.

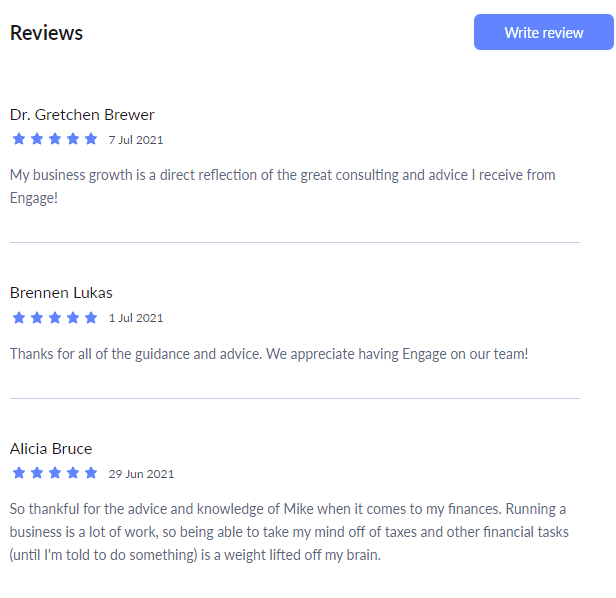

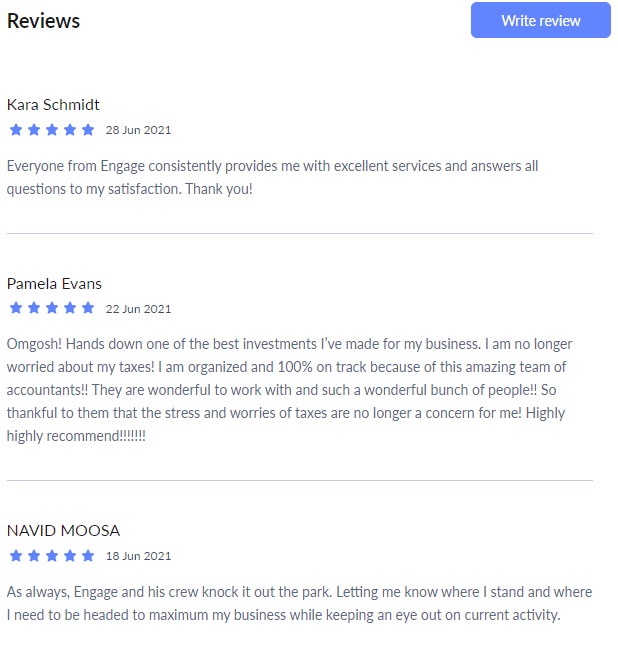

Business owners need someone on their team who can review the numbers with them, interpret them, and provide advice. And since we’re not living and breathing the business 24/7 we can do so without emotions being involved. And that’s what we love to do! Just in the past few days, we’ve gotten some really solid reviews from clients who are having their mid-year meetings that prove these points exactly.

So if you’re still asking yourself if you need an accountant or CPA for your small business, you might want to ask yourself if you can afford not to have one.

————————————————————————————

We’re CPAs turned small business educators. We offer a self-paced course for small business owners that teaches business, accounting, and tax lingo. Entity differences, taxability of income, explaining the various taxes your business might be subject to, answering common questions about financial statements and how to review them, whether you can make enough money to bring home what you need personally, the difference between a subcontractor and an employee, and so many more common questions that we hear so often. Because it will live online forever, you can go at your own pace. Only learn about the business topics that you’re most interested in, and come back to the rest as your business grows and those issues arise. It’s awesome! Check it out below!